Carousel As Metaphor

Yesterday, on behalf of the Pirate Toy Fund, Corey Moran from our team mounted one of the horses on the carousel at the Strong Museum. He revolved in circles, over and over again, through the same toy-filled landscape with little change in scenery, for more than two hours. Thank God he was raising money for a great charity- otherwise, the repetition and monotony of circling back to the same point would have proven to be tedious- perhaps, unbearable. As I was thinking about Corey’s fundraising efforts, I thought that riding a merry-go-round for a chunk of an afternoon was a great metaphor to describe media coverage of the real estate market these past four years. How many times can one repeat the narrative of too many buyers, not enough listings, and dauntingly high interest rates? Rather than strain myself to repackage this all-too-familiar story in different wrapping, I thought that I would quickly summarize some important economic data with a bulleted number of interesting statistics that, I believe, provide a slightly different picture of the local real estate market.

Economic News

After three months of economic data that was increasingly worrisome, the U.S. jobs report was released this past Friday and provided some hope that the stalled war on inflation may have been rekindled. 175,000 jobs were created in April- a meaningful drop from the 315,000 opportunities that were created in March and a substantial number below the 240,000 that were forecast. Meanwhile, the unemployment rate ticked up to 3.9% while average hourly earnings increased more slowly than anticipated. These numbers are important because the Federal Reserve will only begin lowering interest rates when fewer jobs are created – a metric used to signal that the economy is beginning to cool off. Now, before commencing the balloon drop, it’s important to note that this is only one month’s worth of data. And, on average, there were still 250,000 new jobs created each month in the period preceding this announcement. Stay tuned for the next important economic report – the consumer price index, which is set to be released on the 15th of May. Hopefully, we’ll have more confirmation that, indeed, inflation is lagging.

As a result of the jobs report, 30-Year Mortgage rates fell slightly and are currently pegged at 7.28%. Of course, we’d love to see further downward pressure on this key statistic. However, more significant movement of interest rates is usually associated with news having to do with inflation data- thus, the importance of next week’s CPI report.

Some Interesting Data

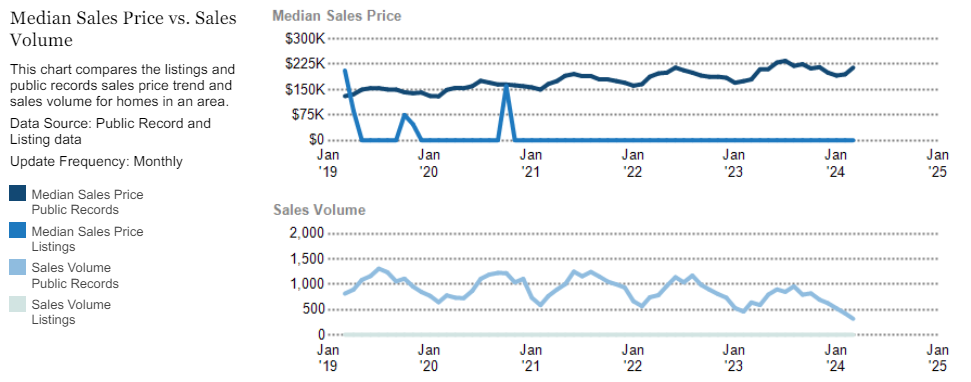

- Property values in Monroe County and the surrounding region have increased nearly 56% in the past four years

- 9.9% of that increase occurred in the past twelve months

- Zillow is forecasting an additional increase in property values of 5% between now and March of next year

- The number of homes available for sale in our community has dropped 60% from five years ago- the seventh highest decrease in the nation

- Nationally, the average household needs an annual income of $120,000 in order to afford to purchase a median-priced home

- 38% of all homeowners don’t believe that they could afford to buy their own home if they were purchasing it today

- The median home-sale price rose from a year earlier or stayed the same in all fifty of the most populous U.S. metropolitan areas during the four weeks ending April 28- the first time that this has happened since July 2022

Phew…

I reported in last month’s blog that our brokerage’s sales declined a startling 26% in the first quarter of this year. Well, what a difference a month makes. The team rallied in April and wiped out all but half a percentage of our loss. We accomplished this Herculean task as a result of selling more than $14,000,000 in residential real estate- our second best month ever. Thanks to all of the clients who chose to buy or sell with us this past month- we’re grateful (and, relieved)! Thanks, also, to our amazing administrative team- I continue to be awed by their ability to bend the universe on behalf of our clients day in and day out! If you’re thinking of buying or selling in the coming months, feel free to give me a call at 330-8750. I’d love to talk!